Audit Says State Windstorm Insurance Program is Failing… Again

After Hurricane Harvey, the windstorm insurer of last resort for the Texas coast is “broke, in debt and facing a shrinking revenue pool.”

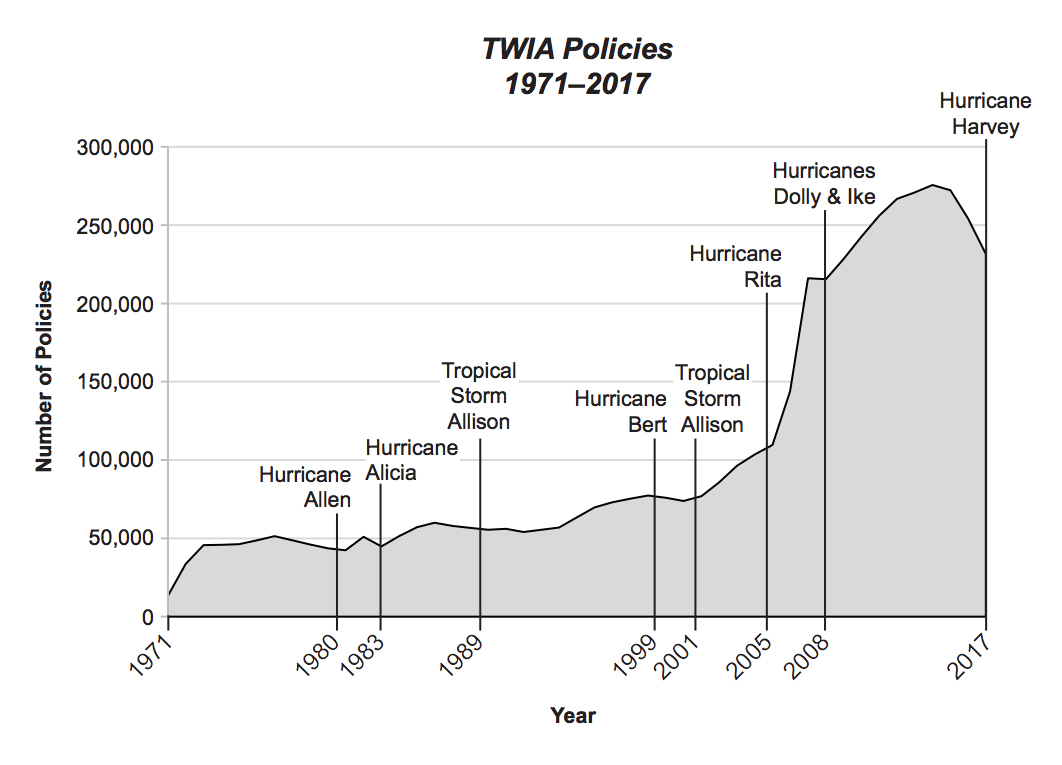

In 2008, after hurricanes Ike and Dolly ravaged the Texas coast and caused more than $30 billion in property damage, the state’s quasi-governmental windstorm insurance agency struggled to process the wave of claims that followed. The Texas Windstorm Insurance Association (TWIA) took more than 250 days, on average, to process more than 90,000 claims. Facing $2.5 billion in losses and thousands of lawsuits over how it handled claims, TWIA was essentially bankrupt.

The following year, in 2009, the Texas Legislature made significant changes to the program with the hope that it would be better prepared to handle the next big storm. Hurricane Harvey, which was strengthened by climate change and brought more than 75,000 claims as of July, was the overhaul’s first real test.

It failed.

A detailed and pointed staff report by the Sunset Advisory Commission, which audits state agencies to ensure they’re operating efficiently, found that in the aftermath of Hurricane Harvey, TWIA is “broke, in debt and facing a shrinking revenue pool.” Hurricane Harvey “revealed fundamental flaws in the design of TWIA’s funding structure and highlighted TWIA’s contradictory directives,” the report notes.

In 14 counties along the Texas Gulf Coast, TWIA is the insurer of last resort. It’s the only option for hundreds of thousands who private insurers won’t cover. Created in 1971 in the aftermath of Hurricane Celia, the number of policyholders relying on TWIA increased dramatically in the 2000s after a series of costly storms led to private insurers abandoning the coast.

Complaints from policyholders of long wait times, unfair assessments and claims of frivolous lawsuits have complicated its operations. As the cost of natural disasters rise, TWIA faces an even more fundamental dilemma, a moral hazard of sorts: By incentivizing people to live in hurricane-prone areas with cheaper insurance — and then bailing them out — is the government-backed agency perpetuating a vicious and dangerous cycle?

The root of the problem, the sunset report notes, is that the Legislature has given TWIA fundamentally opposing mandates. On one hand, lawmakers decided that TWIA would be entirely funded by premiums from policyholders. If a big storm hits and the agency doesn’t have sufficient funds to pay claims, it goes into debt repaid by future premiums. But at the same time, the Legislature intended TWIA to provide windstorm insurance for those who can’t get it anywhere else. If premiums are too high, it may become unaffordable for coastal residents, which in turn limits its ability to pay out claims.

Since its inception, the program has collected $4.15 billion in premiums and disbursed $4.18 billion in claims. Without any state funding to boost its revenue, TWIA finds itself in a bind. Premiums are 32 percent lower than what’s needed for the program to be actuarially sound, largely because of resistance to hiking rates as risk and claims have increased. Functioning as both an independent insurance company and an insurer of last resort is “an unsustainable situation,” the report states.

By incentivizing people to live in hurricane-prone areas with cheaper insurance, is the government-backed agency perpetuating a vicious and dangerous cycle?

And the problem is likely to get worse. Since 1900, 43 hurricanes have hit the Texas coast. That’s a 36 percent chance of a hurricane every year. As the planet warms from emissions of greenhouse gases, scientists have found that storms are intensifying. Hurricane Harvey, for instance, was found to be three times more likely to occur now, as compared to the pre-industrial era. Rainfall increased by about 40 percent during Harvey as a result of climate change, scientists found.

In effect, TWIA is incentivizing people to stay in harm’s way. The increasing risk of living on the coast is being reflected in insurance premiums, said Josiah Neeley, the Texas director of the R Street Institute, a libertarian, Washington, D.C.-based think tank. “From a risk management perspective, if the rates that properly insure a property are so high that no one can afford it, that’s a signal about how risky a property is and whether you want development in that area,” he said. “As more people move to Texas and as you have more growth, that problem ends up being aggravated.”

The sunset report recommends lawmakers look at a number of ways to fix TWIA’s problems, including raising premiums to increase its revenues, diversifying funding by providing additional revenue, reducing commissions to insurance agents and changing the way the agency uses reinsurance.

But reforming TWIA is complicated at the Legislature. For one, lawmakers’ positions are divided by their proximity to the coast. Inland lawmakers balk at the idea of taxpayer dollars subsidizing TWIA premiums; coastal members are opposed to any proposal that raise rates for their constituents. In addition, Republican lawmakers also contend that trial lawyers — who tend to donate generously to Democrats — are abusing TWIA by repeatedly filing lawsuits disputing claims and walking away with large cash settlements.

These fights have scuttled previous attempts to overhaul TWIA. Citing the agency’s depleted funds after Harvey, the TWIA board voted earlier this year to increase premiums by 10 percent. Coastal lawmakers protested against the rate hike and Governor Greg Abbott suspended a section of the state insurance code and delayed the rate hike, “until the Legislature has had a full opportunity to address the matter.”

Of the more than 600 bills filed so far ahead of next year’s 86th Legislature, none are related to TWIA.