Glenn Hegar Releases Better-Than-Expected Revenue Estimate

The legislative session won’t kick off in earnest until tomorrow, but the starting pistol shot came today, when new Comptroller Glenn Hegar released his first biennial revenue estimate. It’s Hegar’s job to predict the levels of funding the state can count on for each biennial budget period, and his estimates set the boundaries of the Legislature’s budget negotiations. He’s basically asked to predict the future and set a ceiling on how much lawmakers can spend.

A number of Lege-watchers, including a number of legislators, expected Hegar to produce a fairly conservative budget estimate. In 2011, the office dramatically overcorrected during the economic slowdown, and the Legislature ended up having to make a lot of unnecessary cuts, especially to public education. The recent oil shock, and some unhappy predictions for the state from a number of national economists, had some thinking that the comptroller’s office would once again play it safe.

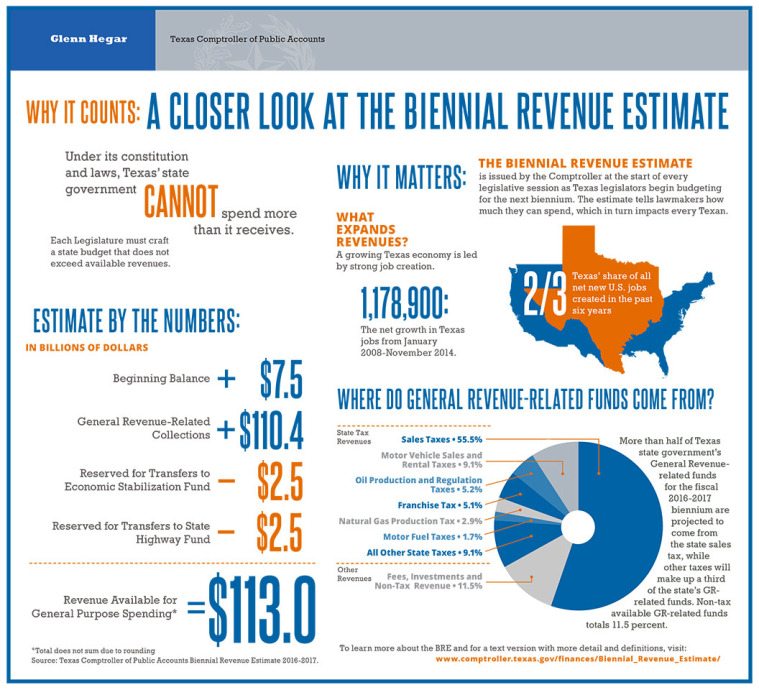

But Hegar’s estimate is comparatively rosy, actually. The comptroller’s office estimates that the state is going to pull in a little over $110 billion dollars during the next biennium, plus $7.5 billion in “surplus” revenue at the end of the current one. With $5 billion of that $110 billion being split between the state highway fund and the state’s rainy day fund, the men and women of the 84th session will have, Hegar says, about $113 billion for the next budget.

To put that into perspective, the budget for the 2014-15 biennium was about $95 billion. According to the left-leaning think tank Center for Public Policy Priorities, it would take $101 billion this session just to maintain the level of services that were provided for in the old budget—new money needed in part because of the state’s rapid population growth. But that would still leave $12 billion for legislators to play with.

On one hand, it’s not a crisis budget, and it’s not one that will require legislators to make cuts (though they might anyway.) The office of Lt. Gov.-elect Dan Patrick released a brief statement that characterized the comptroller’s estimate as a green light for his agenda, which has included the promise of significant tax cuts: It provided “adequate revenue to secure our border, provide property and business tax relief while focusing on education and infrastructure. I intend to accomplish these goals.”

On the other, the “surplus” is a lot less than it looks at first glance, in part because the amount of budget trickery the Legislature has employed over the years. Gov.-elect Greg Abbott and Patrick have called for ending road funding diversions and making the Texas Department of Transportation whole again. But about $3 billion in additional revenue is needed to end diversions, and TxDOT says it needs an additional $5 billion just to keep the system at the current level of congestion—that is, without making any forward progress.

In education, the state has not yet gotten back to the level of funding that preceded 2011’s gargantuan cuts to public ed—a portion was restored in 2013, but a significant amount of money is needed even beyond what was the case in 2011, thanks to population growth. And it’s unclear how proposed voucher programs would affect the system’s overall cost.

And then there’s tax cuts. The truly sweeping tax overhauls that were talked about during the election, like substituting property taxes for increased sales taxes, seem to have fallen off the radar for now. In the past, GOP lawmakers of all stripes have passed minor tax bills and sold them to the voters as massive ones. That may be Patrick’s play, but even modest tax reductions will shave the “surplus” down in a hurry.

On the general state of the economy, Hegar told reporters that he didn’t see Texas heading toward a recession this year. The economy, he said, “will continue to expand, but at a much slower pace than we’ve seen recently.” His estimate, he said, was premised on the price for a barrel of oil returning to $65 a barrel in the last four months of this year, with it continuing an upward trajectory thereafter. That’s roughly in line with Goldman Sachs’ projection, though the Houston Chronicle’s Chris Tomlinson reported industry speculation that the price slump would last 18 months to two years. A lot depends on how it unwinds.

The bottom line: The budgetary picture legislators will be pondering as the session starts is not nearly as bad as it might have been—but it remains difficult to see the state fully coping with long-standing under-investment in schools, roads and social services.