TEA Exoneration of Mike Miles’ Charter Schools Leaves Questions Unanswered, Raises New Ones

An agency report challenging media stories overlooks the charter schools’ compliance with federal tax and state business laws, on the watch of the now-HISD superintendent, while revealing new out-of-state payments.

On October 15, the Texas Education Agency (TEA) released a Special Investigation Report of Findings stating that controversial Houston ISD Superintendent Mike Miles and others associated with the Colorado-based nonprofit charter school network Third Future Schools (TFS) and Third Future Schools-Texas (TFS-Texas) committed no wrongdoing during the three years when $49 million in state and federal education dollars granted to TFS-Texas were managed by, transferred to, or extracted as fees by the Colorado nonprofit.

The TEA report was prompted by investigative stories published by Spectrum News and the Texas Observer earlier this year, in addition to a letter sent to TEA by state Representative Ana Hernandez following the Spectrum story. The TEA report concluded: “No violations of applicable laws have occurred by either the Partnering Districts or Third Future Schools – Texas.”

But the TEA report did not address some issues raised in the news outlets’ investigations, including: the reasons for a financial deficit run by TFS-Texas, which may have run afoul of agreements with Texas school districts; whether the nonprofits had complied with federal tax reporting requirements meant to ensure transparency and proper spending of public dollars; and whether TFS-Texas had complied with provisions of the Texas Business Organization Code.

Following the report’s release, the Observer obtained exhibits—which the report cited but did not include—through an open records request, in addition to interviewing experts for this story. The exhibits reveal, among other things, that TFS-Texas had also moved money out of state to its Louisiana entity, raising a new question about its stewardship of Texas education funds.

Before he was appointed by TEA in June 2023 to helm Houston ISD as part of an unpopular state takeover of the school district, Miles led the Colorado-based TFS charter network. Founded in 2016, TFS ran three schools in the Centennial State under Miles as CEO. In 2020, Miles began expanding operations into Texas under a separate nonprofit entity, TFS-Texas, which during his tenure entered into agreements to run three schools in Midland, Ector County, and Austin ISDs. These agreements were made pursuant to Senate Bill 1882, a 2017 state law that incentivizes districts to hand over struggling public school campuses to private operators in exchange for extra funding, a two-year suspension of any sanctions over performance ratings, and a reprieve from potential state takeover. These in-district charters that SB 1882 incentivized are governed by a different state statute—Subchapter C, Chapter 12, Texas Education Code—than are most charter schools.

In May, Spectrum News reported that, as of mid-2023, TFS-Texas was running a $2.7 million deficit. Spectrum reported that this shortfall may have resulted from the TFS parent nonprofit using Texas tax dollars to cover debts related to its Colorado charter schools, citing comments from TFS staff members and an internal audit stating: “This deficit is caused by the liabilities to other TFS network schools and to TFS corporate.” Spectrum also reported that the Colorado entity had been left with about $5 million in debt from a bond for one of its schools that closed last year due to low enrollment. By June 2023, the Colorado entity’s negative fund balance was $16 million.

In July, an Observer investigation raised further questions about whether the operations of TFS-Texas had run afoul of a number of state and federal requirements. The Observer reported that: TFS-Texas had not disclosed its financial arrangement with TFS on partnership applications filed with the state; neither nonprofit disclosed their relationship on federal IRS Form 990 tax filings; TFS-Texas had failed to maintain a physical address where legal papers can be served; TFS-Texas nonprofit board members were not signatories on its bank account; and TFS-Texas had gone almost a year without opening a bank account in Texas.

In its October investigation report, TEA stated, “There is no merit to the allegations contained in the media reports that state funds were being inappropriately diverted from public school students,” finding that all transfers and fees were appropriate under Texas law. The report also stated that TFS-Texas was not required, under state law, to disclose its arrangements with TFS in the applications filed with the state. The report also revealed that an older TFS-Texas bank account had been opened, prior to that originally identified by the Observer (contradicting a statement a TFS-Texas spokesperson had previously given the Observer).

Many of the report’s findings hinge on the distinction between Subchapter C, Chapter 12, of the Texas Education Code, which covers the in-district TFS-Texas charters, and another subchapter, which contains far more requirements and governs most other charters. Charters like the TFS-Texas schools have “full autonomy over campus operations and the campus budget,” TEA said, and the state ed agency “has no authority over the authorization of the Subchapter C district campus charter schools, the funding structure between the Partnering District and the operating partner, or how the operating partner implements its program with those funds.”

Per TEA, these in-district Subchapter C schools can send money out of state to their affiliates to manage and extract fees without a formal written contract or a disclosure to the state or district, unless the school district specifies otherwise in its own contract with the charter.

TEA said in its report that it “does not have jurisdiction over or authority to investigate alleged inaccuracies in federal tax reporting,” though the agency did weigh in to say that it is not federal law but rather Internal Revenue Service (IRS) “guidance” that nonprofit boards include bank account signatories.

The TEA investigation was led by Theresa Shutey, who previously worked as a math teacher and instructional coach before joining the agency’s Special Investigative Unit two years ago, according to TEA records obtained by the Observer. TEA spokesperson Jake Kobersky told the Observer that “more than 10 SIU staff members,” and “four additional teams within the agency worked on the investigation, including Charter Authorizing, Compliance Review, Financial Compliance, and legal.”

Kobersky declined to answer detailed questions related to the investigation, providing the following written statement via email instead: “The final investigative report and associated exhibits … very clearly lay out the scope and nature of the investigation. Please refer back to those materials. The investigation is closed. TEA has no additional comment.” In an additional comment, Kobersky accused the Observer of “bias” that “continues to prevent the Texas Observer from covering this topic accurately and correctly.”

TFS did not respond to most of the Observer’s specific questions for this story. Spokesperson Whitney Nichols wrote in an email, “The Texas Education Agency conducted an investigation on Austin ISD, Ector ISD, and Midland ISD on allegations of misuse of funds. TFS cooperated fully with this investigation. TEA released their findings and found no misuse of funds with the districts and TFS.”

Among the issues TEA did not address in its report was whether TFS-Texas’ deficit, first reported by Spectrum, ran afoul of agreements with its partner school districts. Both Austin ISD’s contract for Mendez Middle School and Ector County ISD’s contract for Ector College Prep list maintaining a “positive cash flow” as one of the organization’s “financial performance goals,” stating the districts may terminate their agreements if these targets are not met. TFS-Texas did not end its 2022 or 2023 fiscal years with a positive cash balance, according to its IRS Form 990 tax filings and financial statements, the latter being detailed reports that are created as part of annual audits.

Ector County ISD recently decided not to renew its three-year contract with TFS-Texas, which ended in June 2024. School district spokesperson Michael Adkins told the Observer: “In year two, Third Future didn’t make the mark on all the financial goals and the board did not decide to take corrective action. By year three there was no need to take corrective action because the board had already determined it would not renew the contract.”

Austin ISD is currently set to review its own contract for renewal. In an email, district spokesperson Cristina Nguyen told the Observer, “While the 2023 Third Future Schools financial report showed a shortfall, TFS-TX Superintendent Zach Craddock assured Austin ISD officials the shortfall was made up with private foundation dollars.”

TEA’s investigative report did not analyze the reasons for TFS-Texas’ deficit or state exactly how the administrative fees paid to the Colorado entity were determined. Both TEA and TFS have cited a ten percent cap of TFS-Texas revenues for these fees, which translates to around a couple million dollars a year for TFS-Texas. Accounting records included in the report’s exhibits show TFS-Texas paid a total of $1.8 million in “network support” fees in the 2023 fiscal year, while the nonprofit’s IRS Form 990 for the same year shows an expense of $1.5 million for “management fees.” The Colorado parent entity’s financial statement for that year states cryptically: “During the year ended June 30, 2023, the School provided professional services to the Third Future Schools Texas Network. At June 30, 2023, the School reports revenue from the provision of professional services in the amount of $—. Of this amount, $2,389,276 is reported as an amount from related parties on the School’s balance sheet.”

Further, the exhibits show, TFS-Texas also paid $165,000 to the network’s Louisiana entity in November 2023 for curriculum materials and reimbursements. In early November, Louisiana Secretary of State Nancy Landry told the Observer over the phone that TFS-Louisiana was “not in good standing” because it failed to file an annual report updating basic organizational information in May.

TEA’s investigation concluded that there was “no effort to hide” the relationship between the Texas and Colorado entities from partner Texas school districts as that relationship is mentioned in the Texas nonprofit’s bylaws, which were provided to the districts, and as general notes in the Texas entity’s financial statements. TFS-Texas’ bylaws state that the “Colorado nonprofit corporation shall be the sole member of TFS-TX.” In other words, TFS controls the Texas entity, with the authority to “adopt resolutions electing members of the Board of Directors of TFS-TX.”

TFS-Texas’ disclosures may have satisfied the requirements of state education law, per TEA, but Dana Forgione, a certified public accountant, fraud examiner, and professor of accounting at Texas A&M University-Corpus Christi, told the Observer, in a phone interview, that there are additional reporting requirements for nonprofits in federal tax law. “If the entity in Colorado is the sole principal of the entity in Texas, and has full authority to appoint the board, set the bylaws and extract 10 percent of revenues as a management fee; then, in my opinion, that sounds like they are related parties. It sounds like a controlled entity; it sounds like 100 percent control,” Forgione said. “You have to provide detailed financial disclosures [to the IRS], the fair market value of the transactions, the board oversight of the contract management arrangement, any amount of excessive fees, any loss of control.”

In its federal IRS Form 990 tax filings for fiscal years 2021 to 2023, TFS-Texas answered “no” to questions about whether the organization had delegated control over management duties to another entity and if the organization was related to another tax-exempt or taxable entity. Nor did the Colorado entity report any related out-of-state entities on its Form 990 filings in those years.

The IRS requires related or controlled entities to report on Schedule R (Form 990) transactions that an organization has with related entities. TFS-Texas did not file any Schedule R forms from 2021 through 2023, which tax experts say would have needed to document payments to out-of-state entities, as well as transfers that TEA described in its report as “temporary payment of philanthropic funds” and related “reimbursements.”

“That sounds like one of them controls the other and it isn’t being reported,” said Richard Sansing, a professor of accounting at the Tuck School of Business at Dartmouth University, in an interview. “The absence of a Schedule R looks puzzling.”

The IRS requires the reporting of transactions between related entities because “What the IRS gets concerned about is that one entity is going to suck all the resources out of another one,” Forgione said. “They’re worried about whether the mission of this organization is being served, or is the mission being exploited?”

TFS-Texas’ tax preparer and internal auditor, Richard Brozewicz, did not respond to questions about the IRS Form 990s.

In addition to state education funding, TFS-Texas has received federal funding—passed on from its three partner school districts—in the form of pandemic-relief ESSER funds, Title I funding for low-income students, and IDEA funds for students with disabilities, according to district records. Those records show that in its 2023 fiscal year the nonprofit received $5.1 million in federal funds and $928,000 the prior year.

As a recipient of more than $750,000 in federal funding in those fiscal years, TFS-Texas may have been required to file a “single audit”—a financial and compliance audit meant to demonstrate that the recipient organization has adequate internal controls and has complied with federal program requirements—according to the administrative regulations of the Federal Single Audit Act. TFS-Texas filed a single audit covering fiscal year 2021 but filed no single audit for 2022 or 2023, according to the Federal Audit Clearinghouse. Its partner school districts did file single audits, though they lack per-school award information. A Midland ISD spokesperson told the Observer, “Third Future Schools (TFS) is responsible for its audit filings.”

William Bennet, an Office of the Inspector General auditor with the U.S. Department of Education told the Observer via email, “All subrecipients that expend $750,000 or more in federal awards are required to have a single audit conducted,” or a “program-specific” audit for some recipients who received only one type of federal award.

The U.S. Department of Education also announced in March that the TFS Colorado entity would receive an $18.5 million grant “to turn around 45 chronically failing schools over the next five years” in Colorado, Louisiana, Tennessee, and Texas.

TEA’s investigation also did not address questions about whether TFS-Texas has complied with a requirement in the state Business Organization Code that Texas entities’ registered agents have a physical Texas address where an entity can be served legal papers, not just a post office box. As of mid-October, TEA still directed a letter—announcing its investigation’s conclusion—to an address for TFS-Texas that the Observer previously reported the organization had vacated more than a year ago.

Exhibits in TEA’s investigative report also included a June 2024 bank record for TFS-Texas and an August 2024 bank record for the Colorado entity. Those documents still list Miles as a signatory but none of the nonprofits’ current board members, as listed on their websites as of December 2024. Houston ISD spokesperson Jose Irizarry responded to inquiries the Observer sent to Miles, stating, “The superintendent is no longer involved in any way with Third Future Schools’ finances or operations.”

Rick Cohen, a spokesperson for the National Council of Nonprofits said that while federal law does not require that board members be signatories on bank accounts, it is “not best practice” when a nonprofit board lacks signatories. “The board is the body that’s ultimately responsible for the finances,” Cohen said in an interview. “As a signatory, they [board members] have access to see what’s going on in the account and make sure that money isn’t being moved to a place where it’s not supposed to move.”

Some critics have questioned whether the TEA’s investigation of Miles posed a conflict of interest for the agency, which took over Houston ISD in 2023 and appointed Miles to run the state’s largest school district.

Congress member Sylvia Garcia previously told the Observer, “TEA investigating Mike Miles is like the fox guarding the hen house.” Both Garcia and Congress member Al Green have separately called on the U.S. Department of Education to investigate the TFS network, and Green requested the U.S. Department of Justice to conduct a probe. Catherine Grant, public affairs liaison with the Education Department’s Office of Inspector General responded to the Observer’s inquiries about the status of an investigation, stating, “All we can share with you is that we received the lawmakers’ letters from the Department. To be helpful, please know that per our policy, the OIG does not generally confirm nor deny whether it is conducting any particular work. This long standing policy is in place to protect and maintain the integrity of any possible OIG effort.”

Green told the Observer of the TEA report: “I don’t think they [TEA] looked closely enough at some of the things that happened. So I will wait for the federal government to give its report and trust that it will drill down so that we can get to the bottom of what happens when our tax dollars here are sent out of state. This does not make sense, and it cannot make good dollars and cents for taxpayers here.”

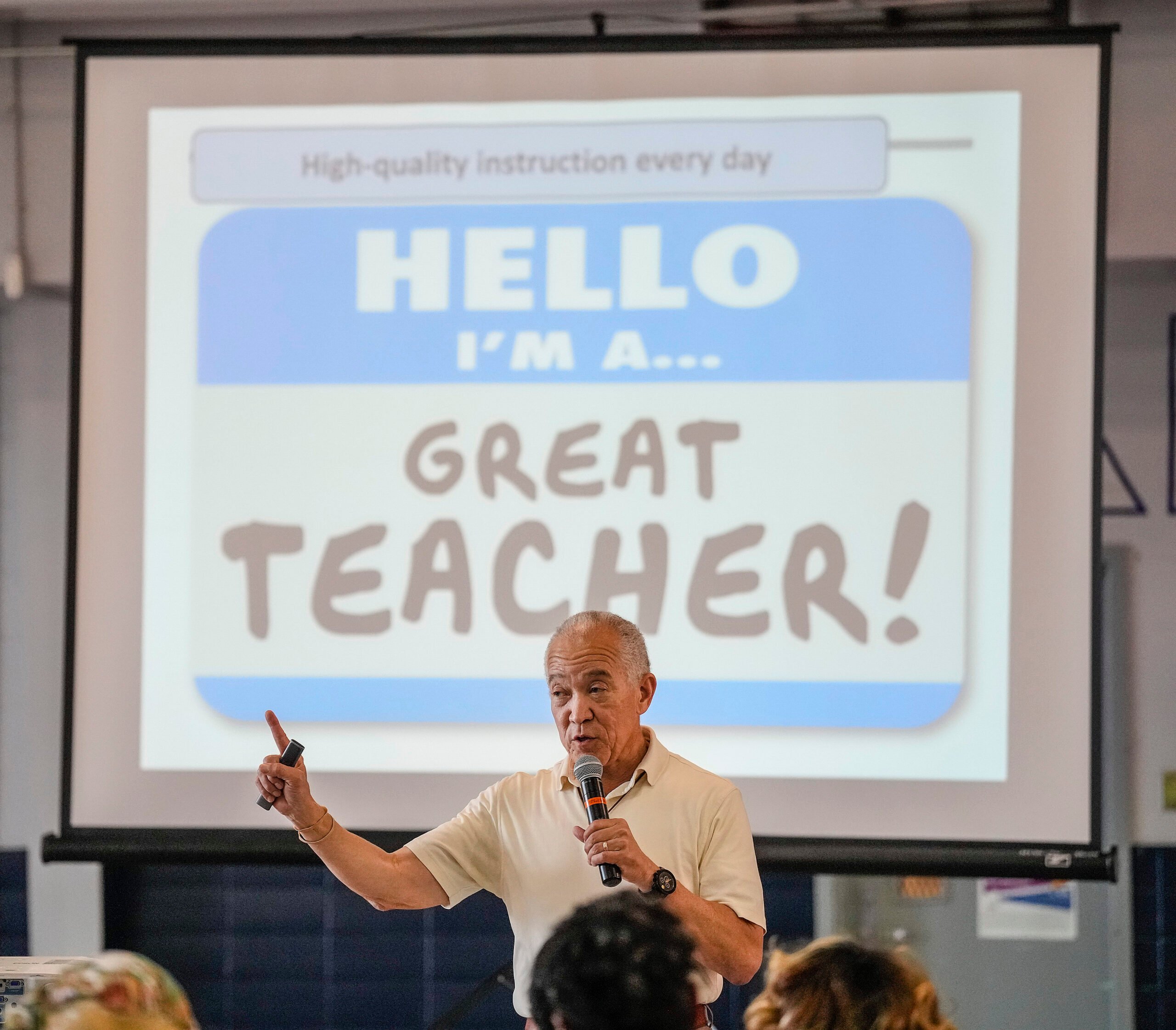

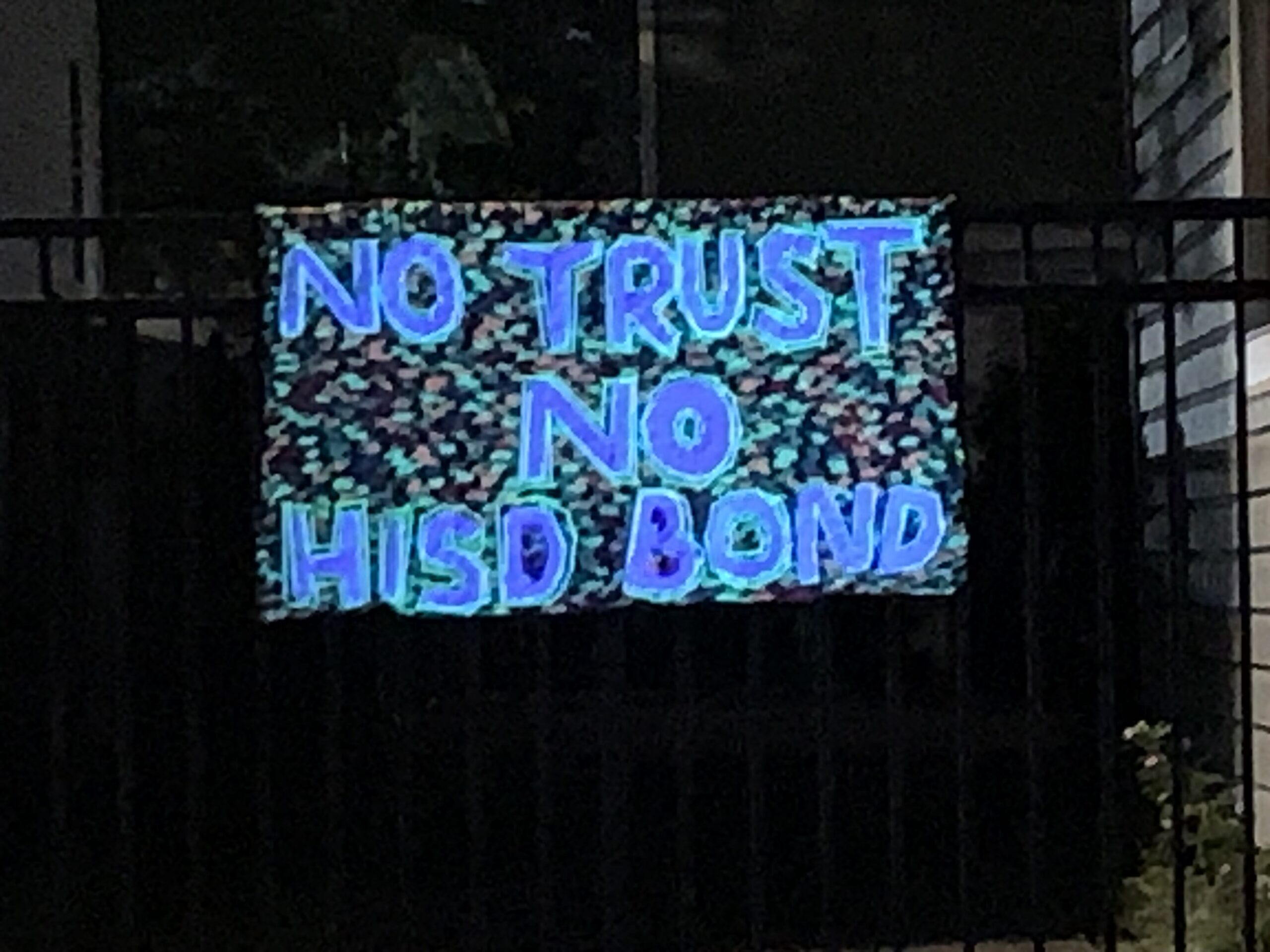

Three weeks after the report came out, 58 percent of Houston voters shot down a $4.4 billion bond package for the Miles-run school district. “The people here don’t want him [Miles] to manage the funds, in no small part because of the way he has managed funds in the past and people don’t agree that you can take Texas tax dollars and allow it to leave the state of Texas,” Green said in an interview prior to the November election.

In August, following the Observer’s reporting, state House Representative Gene Wu led nine other legislators in calling for Attorney General Ken Paxton to audit the TFS nonprofits and review them for compliance with state laws. Wu told the Observer in an interview that the AG’s office has not yet responded, adding, “We knew that they [TEA] would probably not do a proper investigation, but I think this is actually worse. They completely ignored all the different points that people have brought up. … I hope my sarcasm comes out right on paper to say, I’m shocked that the agency that appointed Mike Miles finds that he’s done nothing wrong.”

Lawmakers and public education experts also noted that TEA’s investigation of TFS-Texas—which concluded that in many cases the charter had not violated requirements because no requirements existed in the Subchapter C statute or SB 1882—actually highlighted serious weaknesses in the state law that authorizes such charters.

Patty Quinzi is director of public affairs and legislative counsel with the Texas-American Federation of Teachers, which is now calling for changes to the charter school law based in part on the TEA’s findings.

“The lack of financial accountability and transparency is why you’re seeing things like this happen with Mike Miles,” Quinzi said in an interview. “The reason why TEA said there was no wrongdoing is because technically Mike Miles did not break the [Subchapter C or SB 1882] law. There is nothing in state law that says charter schools cannot send Texas tax dollars to their out of state affiliates.”

Democratic state Senator José Menéndez, coauthor of SB 1882, said the law should not lead to charter schools skirting other laws like federal tax reporting requirements: “I think it’s disgusting and unbelievable the TEA could find no wrongdoing, that they could either ignore federal laws or choose not to see the abuse.” He added that TEA’s investigation report revealed “a complete total abuse and bastardization of the intent of the law,” adding that the agency’s report helped highlight what changes he intends to propose in the next legislative session.

“I can’t believe that TEA is saying that there’s no wrongdoing when they’re taking tax dollars from our system that’s meant for our kids here in Texas to Colorado,” Menéndez said, noting that Texas ranks among the lowest in state funding for public education. “I don’t understand how anybody could be that callous or thoughtless that we’re fighting for every single dollar when we have not increased funding. … And they think it’s okay to take some of our limited resources to Colorado. Do they really think we’re not going to react?”