One Casualty of the Government Shutdown: Low-Income Texans Who Need Housing Assistance

Texas is a super-user of federal housing programs, but the shutdown has brought loans, tax credits and rental assistance to a screeching halt, hurting poor Texans the most.

The heating and cooling units inside Sandstone Foothills Apartments, which houses low-income seniors in Mineral Wells, need to be replaced and the aging elevator servicing the three-story building is overdue for refurbishment. The sidewalks, handrails and entrances at the 40-unit apartment building, located an hour west of Fort Worth, need to be brought into compliance with federal accessibility standards. National Church Residences, the Ohio-based housing developer that owns the property, said it has tried its best to keep up with repairs on the 28-year-old building, but the group needs financial help.

After two years of work, Tracey Fine, a senior project leader at the nonprofit, finally got that assistance in September in the form of a federal tax credit that will generate $4 million in equity — money that will be used to fix up Sandstone Foothills Apartments. “To receive a tax credit award is like the golden prize” because the application process is so competitive and funds are limited, Fine said.

With the award tentatively approved, Fine embarked on her next arduous task: submitting the specific project for approval from the U.S. Department of Housing and Urban Development (HUD), a required step before contracts for the work can be inked. In November, Fine turned the paperwork into HUD. But on December 22, President Trump and Congress came to loggerheads over funding for the border wall; hundreds of thousands of federal employees, including whoever was supposed to evaluate the Mineral Wells project, were barred from their offices indefinitely. Fine needs to close on the project by June, lest she lose the tax credit. But no one’s home at HUD, and even when the government reopens, the approval will likely take time. There’s not a whole lot Fine can do now but worry. “That’s completely stalled right now,” she said.

The shutdown has brought work at HUD and eight other departments across the federal government to a screeching halt, freezing important government services in both rural and urban areas. At the U.S. Department of Agriculture (USDA), which has a sizeable rural housing arm, the employees who annually approve thousands of low-interest loans for hopeful homeowners without access to other financing have been furloughed.

“It is affecting thousands and thousands of families a month to have these programs shut down.”

In Texas, affordable housing programs have been especially hard hit. The Lone Star State is a super-user of federal programs providing home loans to disadvantaged people, as well as subsidizing rent payments in low-income housing units. HUD sends roughly $1.9 billion in rental assistance payments to Texas each year. A sister program, one that paid out $60 million last year and is managed by the USDA, also is caught in the logjam. That agency made its monthly subsidy payments to property owners for January, but there’s no guarantee February’s checks will be mailed. After all, the White House isn’t even paying its own water bill anymore.

Fine isn’t the only one anxious to see how the shutdown shakes out for the Texans who rely on affordable housing. The Beaumont Enterprise reports that HUD funds sent to the local housing authority to help poor people pay rent are stalled; without the money, tenants could be out on the street if property owners decide to evict. Nick Mitchell-Bennett, a nonprofit developer in Brownsville who uses USDA loan programs to build houses in the colonias, told the Observer he’s “scared to death” of what could happen if the shutdown stretches for much longer. “We just don’t know what’ll come,” he said.

“We are seriously concerned … it’s driving housing industry segments to a halt,” said David Lipsetz, CEO of the Housing Assistance Council, based in Washington, D.C. “Even more important, it is affecting thousands and thousands of families a month to have these programs shut down.”

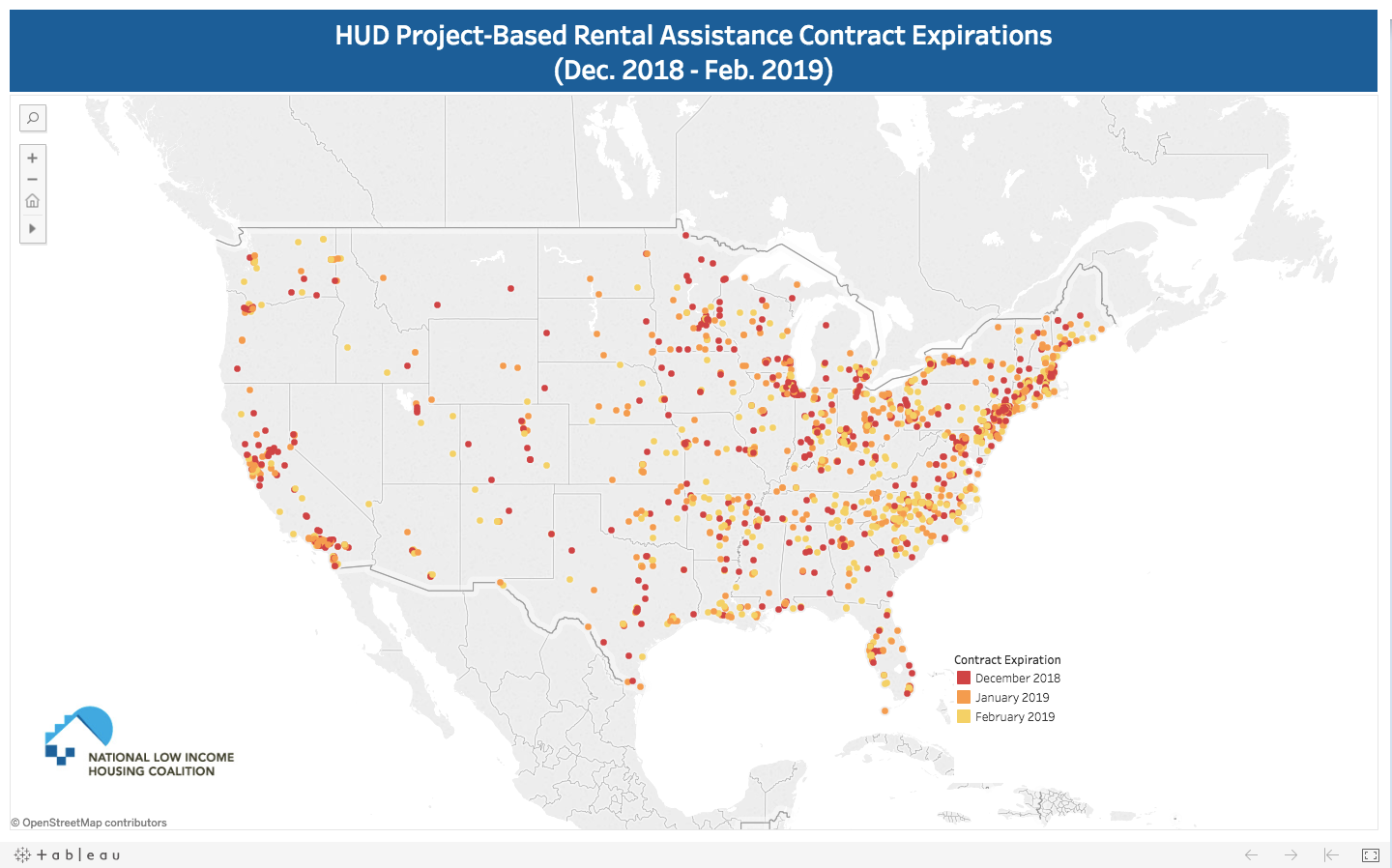

The fallout is expected to worsen the longer the partial government shutdown lasts, experts say. In the past three weeks, HUD has allowed 19 rental assistance contracts with apartment buildings and senior homes in Texas to expire, according to data provided by the National Low Income Housing Coalition. HUD doesn’t send rental assistance payments to properties with expired contracts, and since there’s no one working at the agency to renew them, that funding is stalled. Another 17 contracts are set to expire at the end of January. The developments with expired contracts are clustered in the state’s metropolitan areas, but also crop up outside of the state’s urban triangle in San Angelo, Midland, Decatur and Longview.

So what’s HUD’s solution? Just trust us, they say. The agency has suggested that property owners simply borrow against their reserves to fill the funding gap instead of evicting tenants. “No one has ever been evicted because of a shutdown, and the landlords have always been made whole,” a HUD spokesperson told the Washington Post.

But this is the longest partial government shutdown in American history and arguably the most rancorous federal budget battle in modern U.S. politics. Who knows how this will eventually shake out for some of Texas’ poorest residents? “Everyone feels like we’re in uncharted territory,” Fine said.