Rationale for Texas’ Largest Corporate Welfare Program was a ‘Typographical Error’

What if Texas blew billions of dollars because someone misread an obscure business report 15 years ago?

In March, the Observer took a close look at the state’s largest corporate welfare program, the Texas Economic Development Act, which is meant to attract new business to the state by offering companies big breaks on their property tax bills. The program, often called “Chapter 313” after its place in the tax code, was born 15 years ago out of a fear that Texas was losing its competitive edge to Louisiana, Arizona and other states with generous incentives. As we wrote in March:

For years, Texas had been a perennial finalist for the Governor’s Cup, awarded annually by Site Selection magazine to the state with the year’s most million-dollar development projects. But by 2000, Texas had dropped to 37th.

That was a key piece of evidence used by proponents of the program to sway lawmakers. First cited at a committee meeting at the Capitol in 2001, the No. 37 ranking was later repeated by lawmakers, nonprofits and media outlets (including this one) dozens of times.

But according to a new Senate committee report, that number was wildly inaccurate.

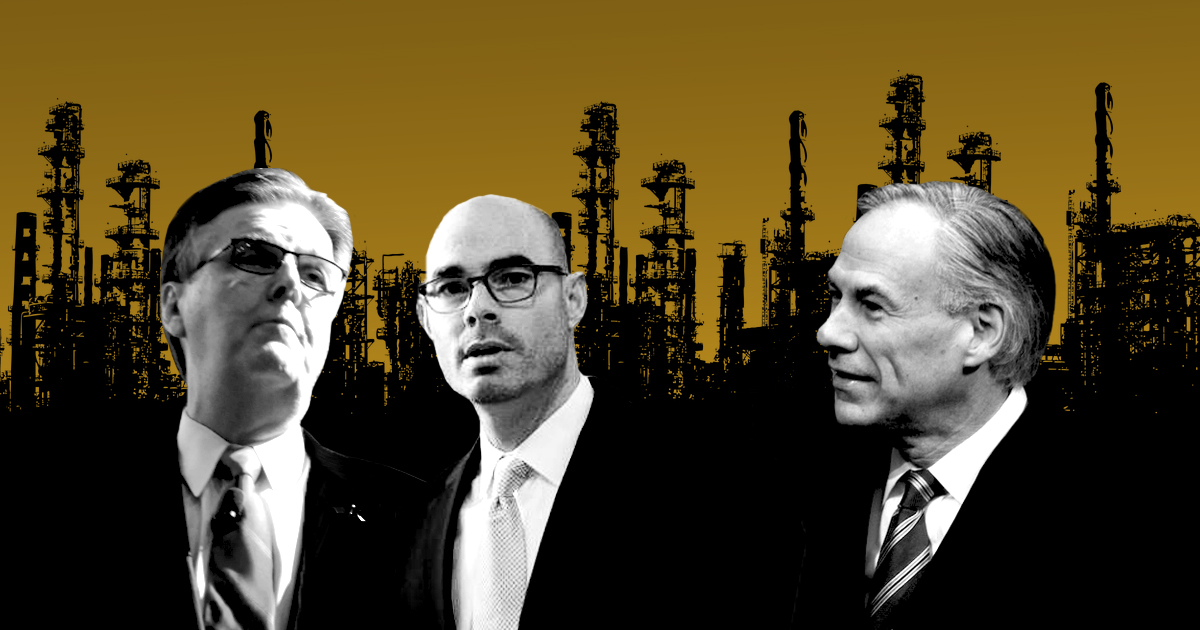

Lieutenant Governor Dan Patrick included a review of the Chapter 313 program in his interim charges for the Legislature, and the Senate Committee on Natural Resources and Economic Development released its findings in mid-November. The report is critical of the program for a number of reasons, but its greatest revelation is that Chapter 313 was initially sold to lawmakers on a lie — or, at least, a typo.

The committee’s review of the March 2001 issue of Site Selection, and its database of new manufacturing plants in each state, shows that Texas actually ranked eighth in the country, not 37th. The report traces the lower ranking to a single chart in the issue, which says Texas attracted just three new corporate facilities from 1998 to 2000 — even though the magazine notes elsewhere that Texas drew 71 new projects in 2000 alone. The publisher’s database manager, Karen Medernach, acknowledged the error in a phone interview in October, according to a footnote in the report.

“The unavoidable conclusion,” according to the report, “is that the case for passing the largest economic development incentive program in the State’s history may have been based on the fear incited by a magazine’s typographical error.”

Dick Lavine, an analyst at the Center for Public Policy Priorities who has been critical of Chapter 313 since its inception, told the Observer that the No. 37 ranking really was central to the argument in favor of the program.

“That was a major part of [former state Senator] Kim Brimer’s pitch, that we had always ranked high in Governor’s Cup rankings and we had suddenly plummeted. He pinpointed property taxes as the problem, and his bill, HB 1200, as the solution,” Lavine said. “This mammoth program, which is costing the state literally hundreds of millions of dollars in foregone property taxes, may have been justified by a typo in Site Selection magazine.”

In fact, the total cost of the program is $7.1 billion, according to the report, counting only deals in place before October. That number will continue to climb, and the law provides no limit.

As we reported, the program puts school districts in the unlikely role of approving these deals, with little oversight to ensure that Texas is getting its money’s worth. There’s virtually no oversight to prevent the state from just giving money away for projects that would have come here even without the incentive.

The report also tackled this fundamental question about the program, finding ample evidence that companies are taking advantage of these tax breaks for projects that they’d probably build in Texas anyway. Proximity to oil and gas production, pipelines, salt domes and shipping channels all make Texas attractive for many companies that have claimed Chapter 313 deals. Wind farms account for the majority of deals under the program, but as the report notes, Texas’ transmission lines and its electric grid make it enticing for wind farm developers.

“Both the wind projects and the manufacturing projects, which collectively account for 94% of all Chapter 313 agreements, have ample reasons for locating in Texas aside from Chapter 313,” the report notes.

Or, as Lavine puts it, “There are many good reasons for these companies to be here, and pay the taxes to support the school system.”

Though the program was written to expire after a few years, lawmakers have repeatedly renewed and expanded it. The latest law authorizing Chapter 313 won’t expire until 2022. But Governor Greg Abbott did veto a bill that would have expanded the program in 2015, and Patrick’s charge to study its “effectiveness and necessity” suggests the state’s leaders could finally have some interest in reining it in.